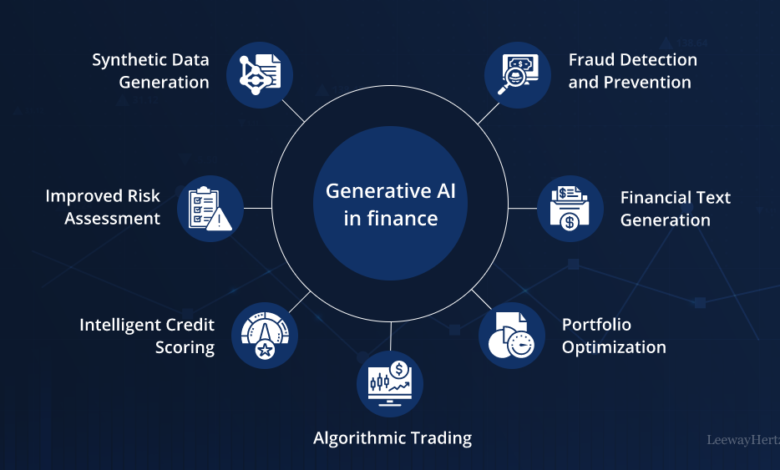

Transforming Finance: Generative AI Applications and Benefits

Generative AI is transforming the finance industry by enhancing decision-making, optimizing processes, and driving innovation. This article explores the role of Generative AI in finance and how financial institutions can leverage this technology for significant advancements.

Enhancing Decision-Making

Generative AI provides financial institutions with powerful tools to enhance decision-making. By analyzing vast amounts of data, AI models can generate insights that support more informed and strategic decisions.

Key Applications:

- Risk Assessment: AI models analyze financial data to assess risks accurately, enabling better risk management.

- Investment Strategies: AI generates optimal investment strategies by evaluating market trends and historical data.

- Fraud Detection: AI detects fraudulent activities by identifying unusual patterns and anomalies in transactions.

Optimizing Processes

Generative AI optimizes various financial processes, making them more efficient and cost-effective. These enhancements lead to improved productivity and reduced operational costs.

Key Applications:

- Automated Reporting: AI automates the generation of financial reports, saving time and reducing errors.

- Credit Scoring: AI models evaluate creditworthiness more accurately by considering a broader range of factors.

- Customer Service: AI-powered chatbots handle routine customer inquiries, providing quick and efficient support.

Driving Innovation

Generative AI drives innovation in the finance industry by enabling the development of new financial products and services. This technology helps financial institutions stay competitive in a rapidly evolving market.

Key Applications:

- Personalized Banking: AI creates personalized banking experiences by analyzing customer preferences and behaviors.

- Algorithmic Trading: AI develops sophisticated trading algorithms that execute trades at optimal times for maximum returns.

- Financial Planning: AI provides personalized financial planning advice by considering individual goals and financial situations.

Partnering with a Generative AI Consulting Company

To effectively implement generative AI technologies, financial institutions often collaborate with a generative AI consulting company. These companies offer expertise in AI solutions and ensure seamless integration and optimal performance.

Benefits of Collaboration:

- Expertise: Access to AI specialists with deep knowledge of generative AI applications in finance.

- Customized Solutions: Tailored AI solutions designed to address specific financial challenges and goals.

- Scalability: AI solutions that scale to support growing financial demands and evolving business requirements.

Enhancing Financial Security

Generative AI enhances financial security by providing advanced tools for fraud detection, cybersecurity, and risk management. These tools help protect financial institutions and their customers from various threats.

Key Applications:

- Fraud Detection: AI models detect fraudulent activities in real-time, preventing financial losses.

- Cybersecurity: AI strengthens cybersecurity measures by identifying vulnerabilities and predicting potential threats.

- Compliance: AI ensures regulatory compliance by monitoring transactions and flagging suspicious activities.

Conclusion

Generative AI is revolutionizing the finance industry by offering powerful tools and solutions that enhance decision-making, optimize processes, and drive innovation. By leveraging generative AI technologies and partnering with a generative AI consulting company, financial institutions can achieve significant advancements in their operations and maintain a competitive edge. As generative AI continues to evolve, its impact on the finance industry will expand, shaping the future of financial services and driving technological progress.