The Benefits of Outsourcing Bookkeeping: Time and Cost Savings for Entrepreneurs

Running a business has always been quite challenging, and especially it became extremely complicated for those who bear multiple roles in a company; for instance, they have to control the company’s operations, plan and implement the company’s marketing initiatives, as well as to perform the bookkeeping, accounting, and payroll services. These are the tasks that are very important in order for the business to carry on as it is supposed to. However, out of all these tasks, bookkeeping is arguably one of the most important yet time-consuming in any business. Business reports are significant since they are tools that enable sound economic decisions, help file accurate tax returns, and to attain lasting business results.

However, handling bookkeeping internally may highly prove to be cumbersome and time-consuming, especially for small businesses and start-ups. This is where outsourced bookkeeping services in UK as well as globally can be very useful to any business and become a lifesaver to the business-minded individual. Based on the hypothesis that outsourcing bookkeeping has distinct advantages for your business, in this blog we’ll look more closely at these advantages from the perspective of operations and growth.

Saving Time for Core Business Activities

Outsourcing bookkeeping may be one of the most appealing benefits to the business since it saves a lot of time for the business people. Bookkeeping includes recording costs, providing employees’ wages, checking bank statements, and generating statements. All these processes take a lot of time and deal with a large amount of information. Time is one of the most significant values for each business owner; however, by performing the bookkeeping process on your own, you would end up spending too much time on the daily work with financial documentation.

By outsourcing these tasks to a professional bookkeeping service, business owners are able to do what they do best, which is to expand the business. Whether a business is venturing into new product lines, new businesses, or attempting to make improvements to business customer relations, time spent on accounting can actually be channelled towards positive production. For most business owners, this is the best thing that could happen, especially because it frees up the people making the choices from having to deal with the processing of data.

Reducing Costs and Increasing Efficiency

One of the benefits of outsourcing bookkeeping services includes cost-effectiveness. Performing bookkeeping tasks in-house requires hiring a full-time bookkeeper. It is costly since it involves paying the bookkeeper’s wage/salary, other benefits, training, and other expenses. For most small companies and especially new ventures, these are some of the expenses that lead to a significant increase in the budget. On the other hand, outsourcing of bookkeeping services is relatively cost-effective in terms of the total costs incurred that are involved in the running of businesses. This entails that instead of having to pay someone a full salary, various businesses can pay for what services they require when they require it.

Business people prefer outsourcing of bookkeeping services in the UK as there are a number of skilled professionals here and the competition in the outsourcing industry is also high. Outsourcing also assists business owners to access quality bookkeeping services at a more affordable price than seeking the services from internal employees. Further, outsourced bookkeeping firms have all the accounting software and present-day technologies that are required for this kind of work, which shall only enhance the processes and reduce the margin of errors up to the minimum.

To the entrepreneur, it means not only having to cut costs but also having to ensure that their accounts are well taken care of. Over-and-out bookkeeping can be more efficient than when done on an in-house basis, whereby the company gets to benefit from better management of its financial resources, proper cash flow understanding, and good planning, which results in the growth and success of the business.

Access to Expertise and Best Practices

Bookkeeping outsourcing organisations within the UK provide specialised services to small businesses that might not have the ability to obtain them within the cost range. The best professional bookkeeping companies hire professional staff having extensive work experience in professional bookkeeping, accounting, and following the financial and other legal measurements along with tax laws and other corporate norms. It is also useful for individuals, who lack sufficient information in relation to finances but would like to encourage the new generations in terms of entrepreneurship abilities.

Outsourcing bookkeeping has some benefits because it provides the owners of entrepreneurial businesses with an opportunity and also a possibility to rely on experts. Such services encompass compliance, tax, reporting, and even the processing of employee payroll services, among others. Large and diverse organisational structures have a more complicated method of bookkeeping, for example, if the business is making money from different sources; or if it is global, and therefore, hiring bookkeeping services may be exceedingly helpful here.

However, outsourced bookkeeping firms ensure that they keep themselves updated with any changes and amendments on the tax laws and any financial regulations so as to assist their clients and help them avoid costly penalties. They also provide outsourced payroll services. Such precautions are especially applicable to the United Kingdom, as the tax legislation is rather comprehensive and often changes. Outsourcing helps the entrepreneur to have confidence that their records are correct, legal, and updated.

Enhanced Security and Data Protection

In matters concerning handling of the financial records, security is an important factor to be considered. It becomes the responsibility of businesses to uphold very strict securities that will prevent fraud and other cyber-related calamities from accessing sensitive financial data. Third-party bookkeeping service providers tend to have better security measures that may not be attainable by a small business.

Professional bookkeeping firms ensure the implementation of strict security standards, which include the use of high-level encryption, cloud storage, and many more, as well as multi-factor identification. These firms are also familiar with rules regarding data protection, including the General Data Protection Regulation (GDPR) in the UK, to meet the legal requirements for handling financial information.

For entrepreneurs, this means that their financial data is safer, so they can have more confidence and assurance that their data is protected. In the current world where incidents of cybercrime are rife, hiring a firm for bookkeeping services already embodied with adequate security features goes a long way in protecting the organisation against data loss and fraud.

Scalability and Flexibility

The development that comes with outsourced bookkeeping services is the scalability it comes with it. We also know that for any business, the need for bookkeeping increases as the enterprise expands. The idea of managing such growth in-house can be a daunting task, especially for small business entities. This means that in outsourcing, a business is assured that they have the human resources for bookkeeping at any point in their development.

For instance, when a company is faced with growth, there may be pressure on increased transactions, payrolls, and reporting where more bookkeepers may be needed. Such additional traffic is effortlessly addressed in outsourcing, as it allows for getting access to more resources and skilled professionals without obligations to formally incorporate them into an organization’s staff. They can also outsource payroll services to the same provider at the time of scalability and growth of their business.

On the other hand, during such periods, the companies can decide to retrench the outsourced jobs, implying that they will only be paying for the specific services they require from the outsourcing firms in question. Such flexibility is especially beneficial for the firms, as the startups or any small companies face changes within their workload and their financial needs.

Improved Cash Flow Management

The management of cash flow is very important for the sustainability and expansion of business at the initial stage and even further. Lack of adequate cash flow is known to be a primary reason for most business failures, especially for those businesses that are new in the marketplace. Several research studies have also shown that outsourced bookkeeping services can also be very relevant when it comes to the management of cash flows since the generated reports are always accurate and timely.

Experienced bookkeepers can keep track of cash flow, analyse problems, and offer suggestions as well to business persons so that they can manage their finances better. This entails following receivables and payables, prompt payments of invoices, and projections of future demands in cash flow. Through proper accounting and issuing periodic reports, outsourced bookkeeping services help entrepreneurs in the UK and globally make the right decisions when it comes to increasing revenue and improving cash turnover for businesses.

Besides, outsourcing providers may provide consultation services on budgeting and financial planning that would allow the organisation to optimise its resources and avoid a situation when it runs out of cash. To small business managers, this proactive process for cash flow management is life-changing and crucial for success.

Focus on Core Competencies

To the average business owner, bookkeeping is not one of the invaluable skills that a person needs to have. Even though this is one of the important functions in managing businesses, it is not often one of the key strengths of business owners because they may have more of a strategic perspective on how to design products or market or approach customers. Through outsourcing bookkeeping, the business owners are able to delegate this ancillary activity to experts, hence leaving them to do what they know best.

Every aspect of the business is handled, not to mention bookkeeping, through which outsourcing services offered by individuals and companies make sure that all the accounts are correct and meet the legal requirements. This can help the start-ups focus on expanding their operations, coming up with improved products or services, and establishing rapport with clients and other stakeholders. This remains one of the benefits of outsourcing in the context of a competing environment, especially with limited time and resources available.

Conclusion

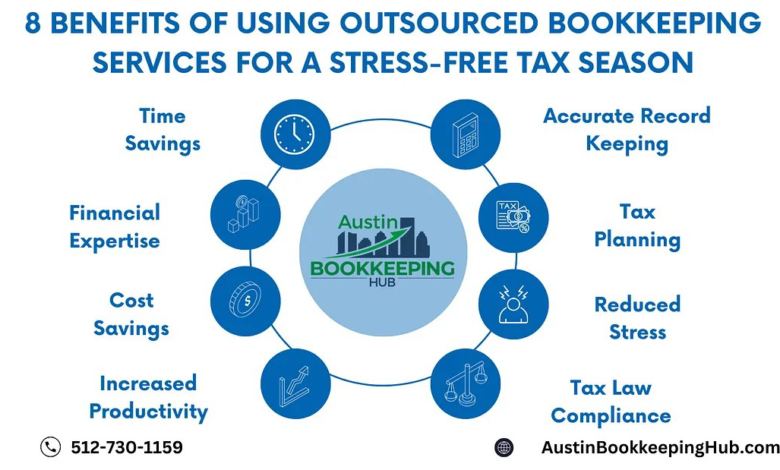

Outsourcing bookkeeping proves to be very beneficial to entrepreneurs, especially regarding the management of time and cost. Hence, this important responsibility should therefore be left in the hands of experienced professionals so that business people can concentrate on the actual business of expanding their enterprises. Secondly, one of the benefits achieved by outsourcing is gaining access to experts concerning security and scalability, making outsourcing ideal for startups and small businesses in the UK.

Furthermore, there are so many benefits that business owners derive from outsourced bookkeeping services, such as the knowledge through which professionals will handle their records well, efficiently, and without compromising on accuracy or compliance with the law. It not only enhances the efficiency in revenue management but also the success and perpetuity of the enterprise.

Looking at the present world as a very complex and competitive business environment, outsourcing of bookkeeping is a sound business strategy that will not only save an entrepreneur money but also time and focus on the expansion of their business. Because there is still a high demand for outsourcing bookkeeping services in the UK, other business owners are now aware of the usefulness of the method and receive professional bookkeeping services.

We at Corient offer a wide range of outsourcing services in and outside the UK. These include management accounting, outsourcing bookkeeping services, outsourced payroll services, and tax and VAT outsourcing. Let us take care of your business with all the latest technology that best fits your company’s needs and requirements, so you can concentrate on building a successful company.

Contact us today to get yourself the best outsourcing bookkeeping services near you that can help you streamline your accounting process, and save time and cost!