Introduction

Financial transaction security is paramount. One of the key tools that helps ensure the protection and efficiency of payments is the BIN checker. This tool allows for the verification and validation of Bank Identification Numbers (BIN), playing a crucial role in fraud prevention and the optimization of financial processes.

In this article, we will take an in-depth look at what BIN checkers are, why they are necessary, and how they are used across various fields, including media buying. We will also analyze several popular BIN checkers and their functions to help you choose the most suitable tool for your needs.

What is a BIN Checker?

A BIN checker is a tool designed for the verification and validation of Bank Identification Numbers (BIN). A BIN comprises the first six digits on a credit or debit card, identifying the card-issuing bank, the card type, geographic location, and other pertinent information.

Some modern payment tools feature unique BINs, each with its characteristics and role in ensuring financial transaction security. These BINs represent reliable and verified numbers that reduce the risk of falling into the Risk Payment category. They provide stable operation and confidence in payment security.

Why Do You Need BIN Checkers?

Primarily, BIN checkers are used to select a reliable card for the necessary platform. With comprehensive information about a card, you can minimize the risk of payment rejections. BINs might be unsuitable for advertising payments for various reasons. Some cards could be blocked by anti-fraud systems due to associations with accounts violating platform rules. Other cards might not be suitable solely due to their type or country of issue, as restricted by the advertising platform itself.

BIN checkers help companies minimize risks and ensure the reliability and transparency of financial transactions.

- Fraud Prevention: One of the main reasons for using BIN checkers is to prevent fraud. They allow for the quick identification of suspicious cards and the avoidance of transactions from unreliable sources.

- Verification Process Improvement: BIN checkers help companies verify cards faster and more accurately, enhancing the overall user experience and speeding up payment processes.

- Analysis and Statistics: Marketers and analysts can use BIN checkers to collect data on the types of cards used by their clients, aiding in the development of more targeted advertising campaigns.

- Regulatory Compliance: In certain industries, using BIN checkers helps companies comply with data security and payment processing regulations.

In the next part of this article, we will review some of the most popular BIN checkers used in media buying.

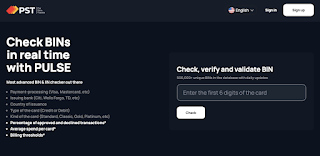

- “Pulse” by PSTNET

PSTNET is a financial platform specializing in the issuance of virtual cards. These cards are frequently used for purchasing advertising on popular platforms such as Facebook, Google, TikTok, and many others.

In addition to their virtual card services, PSTNET offers a convenient BIN checker called “Pulse” on their website.

To use the PSTNET BIN checker, simply enter the BIN into the designated field on the website. The system will then quickly provide detailed information about the card.

The main features of the PSTNET BIN checker include:

- Payment Processing Information: Identifies how payments are processed (Visa/Mastercard).

- Card Issuer Identification: Determines the issuing bank of the card (e.g., Citi, Wells Fargo, TD, and others).

- Country of Issue: Identifies the country where the card was issued.

- Card Type: Specifies whether the card is credit or debit.

- Card Level: Indicates the card’s level (standard, classic, gold, or platinum).

- Approval Rate: Shows the percentage of approved transactions.

- Rejection Rate: Indicates the percentage of rejected transactions.

- Average Spending: Provides information on the average expenditure on the card.

- Billing Thresholds: Details the billing limits.

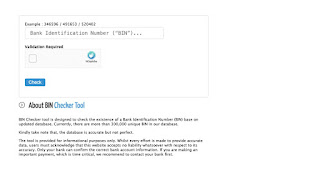

- BIN-codes BIN Checker

The “BIN-codes” platform is a kind of BIN library. The website claims to have information on more than 300,000 unique BINs, regularly updated.

Once you enter a BIN into the search bar, you’ll need to pass a recaptcha.

The main functions of the BIN checker include identifying:

- Card Brand: for example, VISA or American Express

- Card Type: Credit or Debit

- ISO Country Name

- ISO Country Number

For some cards, you can also find:

- Issuer’s Website

- Issuer’s Contact

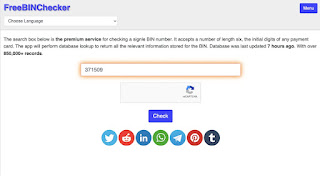

- BIN-checker by FreeBINChecker

FreeBINChecker is a tool that operates with its own database containing over 800,000 BINs. The site indicates the last update time for the data.

To use the BIN checker, you’ll also need to enter the BIN in the search box and pass a recaptcha.

After that, the service will provide you with the following information:

- Type of card: credit or debit

- Scheme: American Express or Mastercard

- Category

- Issuer: for example, American Express Us Consumer

- Prepaid Card: true or false

- Commercial / Business Card: true or false

- Country: United States

- Country Code: US

- Currency: USD or something else

- BIN Checker by binlist.net

binlist.net is a publicly available web service for searching metadata of credit and debit cards. Its key advantage lies in the use of card data from various sources, ensuring more accurate and up-to-date information.

After requesting information about a BIN card, the service will provide the following data:

- Payment System: for example, Visa

- Card number length: 16 digits

- LUHN check: Yes or No

- Card type: debit or credit

- Prepaid: Yes or No

- Country: Where the card was issued

- Bank: Name of the bank that issued the card

- Bank contacts: website and phone number

- BIN Checker by VccGenerator

The BIN checker from VccGenerator is a free tool for checking BINs, which helps quickly and accurately determine information about a bank card and its issuer. To use it, you need to pass a recaptcha, ensuring security and protection against automated requests.

After successfully passing the verification, the service will provide the following information:

- Card brand: for example, Visa, MasterCard

- Card type: debit, credit, prepaid, etc.

- Card level: standard, premium, etc.

- Additional details: country of the issuing bank and its contact information, such as phone and address.

Also Read: Keeping Private Enterprise Data, Private

Conclusion

The use of BIN checkers not only helps companies ensure the security and transparency of financial transactions but also enhances user experience, accelerates verification processes, and ensures compliance with regulatory requirements. Ultimately, choosing the right BIN checker can significantly improve the efficiency and reliability of working with payment cards, which is particularly crucial in the rapidly evolving market and increasing threats of fraud.

Selecting quality tools for BIN verification is a prudent step for any company aiming for stability and security in its financial operations.

We have reviewed several popular BIN checkers such as “Pulse” by PSTNET, BIN-codes, FreeBINChecker, binlist.net, and VccGenerator. Each of them offers unique features and capabilities, allowing users to obtain detailed information about bank cards, their issuers, and terms of use.